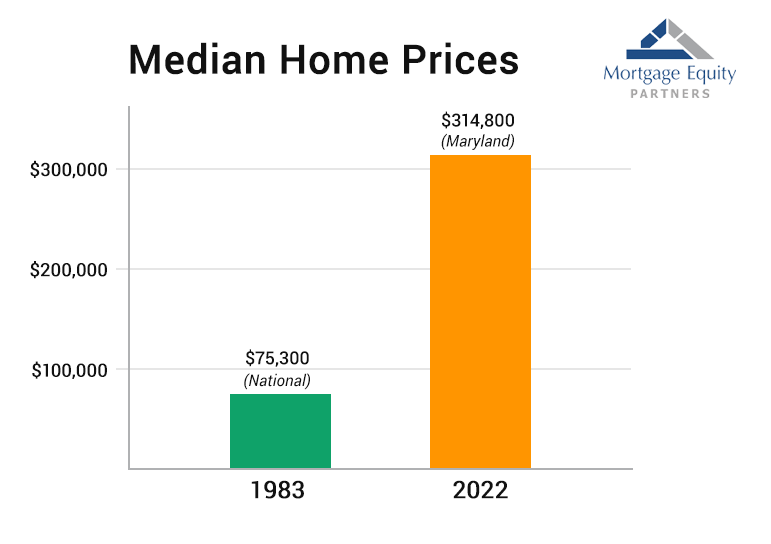

First-time homebuyers have become increasingly frustrated as they try to enter the housing market. However, if first-time homebuyers compare home prices and rates to what previous generations paid, they may be shocked by what they learn. For example, decades ago, the average home price was a fraction of what it is today, and the interest rate was more than triple.

In the Mid-Atlantic states of Maryland, Virginia, and the DC area, houses are much more expensive today than 40 years ago; however, the average mortgage interest rate in 1983 was 18.63%.* That means that it cost a lot more to borrow money back then than today.

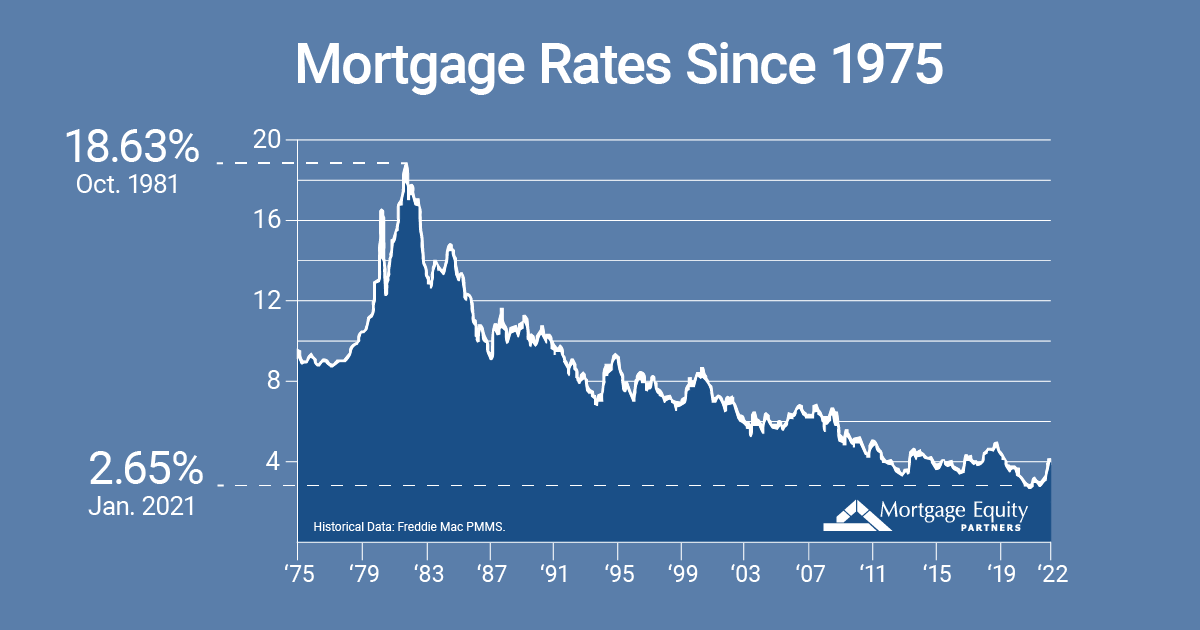

When homebuyers get frustrated with an interest rate in the 5s, they must understand it is still a fantastic interest rate. For example, in the early 1980s, rates around 15% on a 30-year fixed-rate mortgage were not uncommon. However, if you look at historical housing data, you can see that rates have been on a downward trend since then.

Over the past several years, we have gotten accustomed to expecting rates in the 2 – 3% range. Most millennial homebuyers entering the housing market have not experienced high-interest rates in their adult lifetimes.

The good news is the dream of homeownership is still alive and well. In fact, a recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American Dream. This strong desire for homeownership has also kept the demand for homes growing and home values appreciating.

Another recent factor contributing to increased demand for homes occurred during the pandemic when people were largely confined to their homes. A trend emerged that people wanted to buy a new bigger house with more features. Many trending blogs focused on what homeowners were looking for in a new home. People were looking for more space, a home gym, and work from home office space. Many homebuyers wanted a bigger yard and more outdoor living space, and moving out of the cities was a huge trend. Many younger people living in urban areas decided to move to the suburbs and take the leap to become a homeowner instead of continuing to rent. Also, during the pandemic, building new homes slowed down significantly, and it became challenging to get building supplies. Those factors all had a significant impact on home inventory.

The housing market is seasonal, with the home buying and selling season beginning in earnest now in most areas of the country. Homeowners still generally try to wait to move until the end of the school year when the timing is less disruptive to school schedules and when the weather is more cooperative.

While some say it is not a good time to buy, other industry experts give the following reasons to buy now:

- Home values continue to appreciate

- Affordability may decline soon

- Incomes have increased

- Rising Interest rates

- Buying power to fall

Many lenders are trying to offer programs to make the rate increase easier to accept. For example, adjustable-rate mortgages are being talked about again. In rate increase environments, lenders may increase the marketing of adjustable-rate mortgages. Rising mortgage rates and falling affordability spur interest in ARMs because they help boost purchasing power by lowering monthly mortgage payments. Could this happen again as rates continue to rise?

What else can homebuyers do in this uncertain market to protect themselves against rate increases?

Mortgage Equity Partners offers a lock to shop program designed for a rate increase environment. Our lock to shop program will give you peace of mind by locking in your rate before locating your new home. Lock to shop protects you from market rate increases as you shop. The program also provides you with a fully underwritten loan commitment that makes you a more competitive buyer, and the loan process will be more straightforward when you officially apply. In addition, if the rate has dropped during your home search, you will have a one-time option to modify to the lower rate for a nominal fee.

The bottom line is that there will always be some segment of the population that will need to move sooner or later, and all these factors won’t matter. Lenders are trying to make it easier for homebuyers to get the best rate and win the bidding war by creating innovative programs. But it is generally agreed that rates are on the rise, so while it may sound cliché, working with an experienced loan officer who has seen market fluctuations and rate increases is critical. Irina Spector and Emma Lebedev and their team can help guide you through the process. And keep in mind that at one point in time, not so long ago, mortgage rates were in the 18s.

Sources:

- FreddieMac*

- gobankingrates.com**

- worldpopulationreview.com

- realtor.com

- National Association of Realtors (NAR)